Safe Guard Yourself From Employee Retention Scams

The global challenges posed by the COVID-19 pandemic prompted governments worldwide to adopt unprecedented measures to bolster economies and assist businesses and individuals. In the United States, one such measure is the Employee Retention Credit (ERC), a refundable tax credit designed to aid businesses facing closures or significant revenue declines due to the pandemic.

Nevertheless, alongside its benefits, the IRS has issued a series of warnings about the potential complexities and pitfalls associated with claiming the ERC, cautioning against misleading promoters. The ERC was introduced as part of broader COVID-19 relief efforts to encourage employers to retain their workforce despite economic uncertainty, offering financial support to eligible businesses experiencing operational suspensions or gross receipt declines. Despite the genuine intentions of the credit, the IRS highlights concerns about misinformation surrounding eligibility and the claiming process.

Understanding the ERC Guidelines

Before delving into the warnings and scams, it's crucial to have a clear understanding of the ERC guidelines. The credit is available to businesses that meet certain criteria:

Suspension of Operations: Businesses that experienced a full or partial suspension of operations due to COVID-19-related government orders during 2020 or the first three quarters of 2021.

Gross Receipts Decline: Businesses that faced a significant decline in gross receipts during 2020 or the first three quarters of 2021.

Recovery Startup: Recovery startup businesses that qualified during the third or fourth quarters of 2021.

Have questions?

Schedule a meeting with our expert team today and unlock the full potential of ERC for your business.

BOOK A FREE CONSULTATION

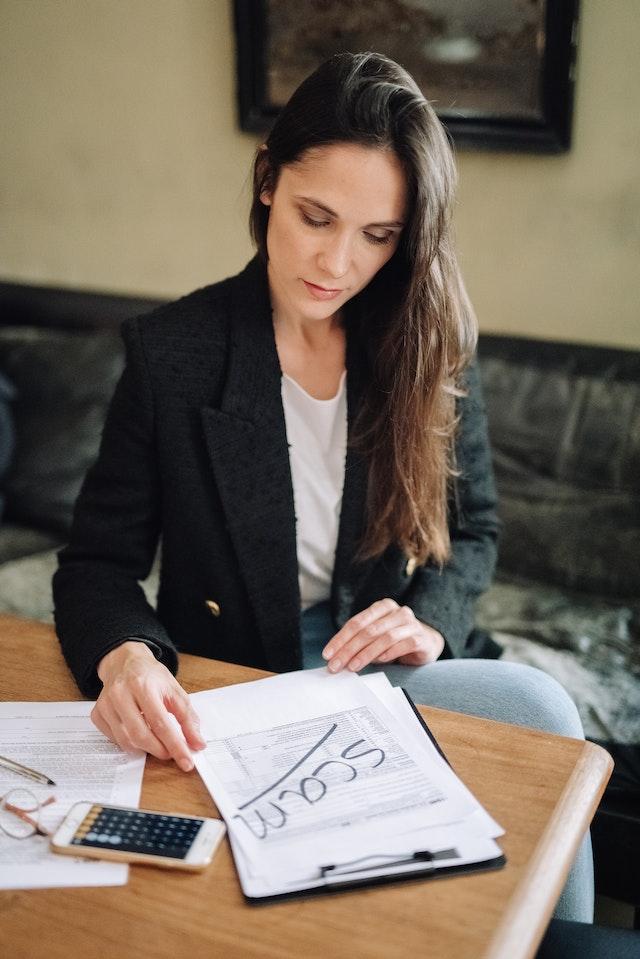

IRS Warnings and Scams

The IRS has been vigilant in warning taxpayers about fraudulent schemes related to the ERC. They have emphasized the following key points:

Aggressive Promoters: The IRS has repeatedly cautioned against promoters who aggressively mislead individuals and businesses into believing they can easily claim the ERC. These promoters often charge exorbitant fees and may promise quick and significant refunds.

Misleading Claims: Scammers may make exaggerated claims about eligibility and the ease of the application process. They might promise fast money without a proper evaluation of the individual's or business's circumstances.

Upfront Fees: One of the red flags raised by the IRS is the demand for large upfront fees to assist in claiming the credit. Some scammers even base their fees on a percentage of the refund amount, a practice that legitimate tax professionals generally avoid.

Identity Theft Risk: Some scams aim to collect personal information from unsuspecting victims. Scammers may use this information for identity theft or other fraudulent activities.

Have questions?

Schedule a meeting with our expert team today and unlock the full potential of ERC for your business.

BOOK A FREE CONSULTATION

Protecting Yourself and Your Business

As the IRS warnings suggest, the best way to protect yourself and your business from ERC scams is to be well-informed and rely on trusted tax professionals. Here are some steps you can take:

Educate Yourself: Familiarize yourself with the ERC guidelines and eligibility criteria. Visit the official IRS website for accurate and up-to-date information.

Work with Trusted Professionals: Seek guidance from reputable tax professionals who have a proven track record of providing accurate and reliable advice.

Question Aggressive Claims: If a promoter's claims sound too good to be true or involve hefty upfront fees, proceed with caution. Legitimate professionals focus on accurate advice, not exaggerated promises.

Avoid Unsolicited Offers: Be skeptical of unsolicited offers, calls, or emails about the ERC. Scammers often rely on these tactics to reach potential victims.

Report Suspicious Activities: If you encounter suspicious ERC-related activities, such as aggressive advertising or misleading claims, report them to the IRS and relevant authorities.

The Employee Retention Credit has undoubtedly provided crucial financial support to businesses during challenging times. However, as with any financial benefit, there are those who seek to exploit it for personal gain. The IRS warnings emphasize the importance of careful consideration and adherence to the guidelines when claiming the ERC. By staying informed, working with trusted professionals, and remaining vigilant against scams, businesses and individuals can keep themselves safe from those who seek to exploit others